Both Parties Move to Aid Homeowners

Posted by tothewire on February 5, 2009

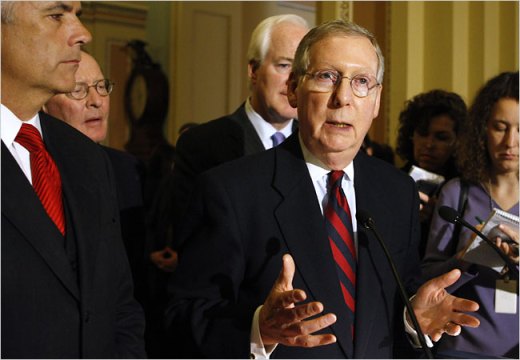

“Most people recognize that housing itself is at the root of the current economic downturn,” Senator Mitch McConnell said. “We should fix this problem before we fix anything else.”

WASHINGTON — Four months after Congress tried to rescue the economy with a $700 billion bailout for the financial industry, Republicans and Democrats are suddenly competing to bail out financially struggling homeowners.

Having spent hundreds of billions of dollars rescuing financial institutions, only to see the economy spiral even deeper into crisis, liberal and conservative economists and lawmakers are pushing to redirect the economic stimulus bill to what they say is the core problem: the housing market.

Senate Republicans are seeking new tax breaks and up to $300 billion in mortgage subsidies to attract homebuyers. Democrats want to spend at least $50 billion on federal programs aimed at reducing mortgage foreclosures.

The Obama administration is hammering out its own plan to spend $50 billion to $100 billion to prevent home foreclosures. And later this month, Democrats hope to pass a measure that would give bankruptcy judges the power to reduce monthly mortgage payments for homeowners who are in default.

There is a growing consensus among lawmakers in both parties that the deepening collapse of the housing market is at the heart of the country’s acute economic downturn.

But beneath the consensus over helping the housing market, there are huge differences over who should benefit under the competing plans. Democrats want to aim money directly at people in the greatest distress; Republicans want to aim money at almost all homebuyers, on the theory that a rising tide will eventually lift all boats.

“Most people recognize that housing itself is at the root of the current economic downturn,” said Mitch McConnell of Kentucky, the Senate Republican leader. “We should fix this problem before we fix anything else.”

Democratic lawmakers do not disagree, but they complained that the Republican wake-up call amounts to posturing.

Democratic lawmakers fought for months last year, without success, to pressure the Bush administration into spending money from the $700 billion financial industry rescue program on reducing mortgage foreclosures.

But Democrats have been forced to rethink elements of the stimulus package, which originally was conceived as boosting almost every other part of the economy on the theory that Congress and the Obama administration would tackle the housing problem through other means.

Senator Kent Conrad, Democrat of North Dakota and chairman of the Senate Budget Committee, warned on Tuesday that he could not support the stimulus bill unless lawmakers redirected $50 billion to programs aimed at homeowners.

Mr. Conrad called for providing about $20 billion to expand foreclosure-reduction programs at the Federal Deposit Insurance Corporation, as well as money to expand an existing tax credit for homebuyers.

In addition, Mr. Conrad wants the Obama administration to devote the remaining $350 billion in the Troubled Asset Relief Program to helping banks, not homeowners.

“There is not sufficient money in the TARP to deal with both the housing crisis and the financial crisis,” Mr. Conrad said in an interview on Tuesday. “They’re going to have to come back to us and ask us for $300 billion to $500 billion more, just for the financial sector.”

President Obama and senior Senate Democrats have also signaled that they would support Republican proposals for a $15,000 tax credit for homebuyers. Indeed, Senate Democrats were reviewing ideas on Tuesday that would outdo the Republican proposal by offering the tax credit to all homebuyers. Depending on the details, the tax credit would cost $6 billion to $20 billion, Democratic lawmakers said. Under current law, first-time homebuyers receive a tax credit of $7,500.

Falling home prices and soaring default rates on subprime mortgages were at the heart of the credit crisis that began in August 2007, which crippled Wall Street and the nation’s banks. But starting last September, the economy itself slipped from a mild recession to a severe one. As a result, analysts say, the housing crisis and the financial crisis have both become worse and begun to reinforce each other.

Home prices have fallen 25 percent since the housing bubble peaked in 2006, representing a $6 trillion loss in wealth. About 2.2 million homes went into foreclosure in 2008, according to the Mortgage Bankers Association, and analysts predict that number could hit a record four million this year.

Even though home-building has been depressed for almost two years, the soaring number of foreclosures has continued to drive prices down and kept the supply of unsold homes at extremely high levels.

Analysts caution that any sweeping effort to reduce mortgage foreclosures would pose daunting challenges. The biggest challenge would be providing financial help to the three million people who are in real trouble without starting a rush to cash in by the tens of millions who are not.

But Richard Berner, chief economist at Morgan Stanley, said that ignoring the problem would be even worse.

“Home prices, housing activity and both mortgage lenders and borrowers will suffer,” Mr. Berner wrote in a recent report. “The economic cost of such further declines would exceed the cost of mitigation.”

The Treasury Department is racing to complete a broad plan that is all but certain to include an expansion of the F.D.I.C.’s program to renegotiate loans for homebuyers at banks it has taken over. Under that program, the F.D.I.C. attempts to reduce a person’s monthly payment to about 31 percent of his or her income. The reductions can take place by reducing the interest rate, stretching out the life of the loan or reducing the principle amount of the loan.

House Democrats, meanwhile, have proposed legislation to expand a program called Hope for Homeowners, which was created last year to help distressed borrowers refinance to a relatively inexpensive fixed-rate loan insured by the Federal Housing Administration.

Since its inception last year, the program has attracted only a handful of applications. Critics have argued that the program’s high up-front fees and annual premiums made the loans expensive. On top of that, homeowners are required to share any eventual profits on the sale of their homes.

The Republican approaches are aimed much more at boosting the entire housing market, and would only provide indirect relief to families about to lose their homes.

Mr. McConnell has proposed that the federal government subsidize mortgages with a fixed interest rate of 4 percent to 4.5 percent. Fannie Mae and Freddie Mac, the two government-controlled mortgage-finance companies, would use their buying power in the mortgage market to drive the rates down.

The plan was developed by R. Glenn Hubbard, a former senior economic adviser to former President George Bush who is now dean of Columbia University’s business school, and by Christopher Mayer, vice dean of the business school.

The low rates would be open to any “creditworthy” borrowers, which would probably exclude many if not most homeowners who are now facing foreclosure. But supporters of the plan argue that it would help lift housing prices, which would make it easier for troubled homeowners to either refinance or sell their houses.

But senior Democratic lawmakers are staunchly opposed to the plan, warning that the costs could climb as high as $1 trillion.

By EDMUND L. ANDREWS

Both Parties Move to Aid Homeowners « A Different Kind of Blog | relationmortgage.com said

[…] Both Parties Move to Aid Homeowners « A Different Kind of Blog […]

LikeLike

Popular People » Blog Archive » Money Or Sex? said

[…] Both Parties Move to Aid Homeowners « A Different Kind of Blog […]

LikeLike

fadingad said

There was a bailout company handing out $50 bills to anyone who would wait on line for it yesterday in Manhattan. Great publicity stunt. Expensive but great.

LikeLike

Losing Weight…Yeah Right! » Blog Archive » High Hurdles For Obama Energy Plan said

[…] Both Parties Move to Aid Homeowners « A Different Kind of Blog […]

LikeLike

Lawman2 said

$50.00 bills? lol i would say it was a great publicity stunt!good to read ya again frank!

LikeLike

Anonymous said

that’s a good thing. banks not making it easy to give mortgage loans or refinancing..lots of houses for sale, for almost half the value. homeowners not able to afford high mortgages end up foreclosing. those who want to buy cannot get loans. many cases of greedy mortgage companies upping the mortgage instead, to those whose credit and payment history are good and seeking to refinance. looks like they are trying to take from those doing okay financially, taking advantage of them wanting to keep their good credit scores.

LikeLike

Lawman2 said

good concise points there anonymous!

LikeLike

KkvkVc said

news xanax how long does it last – xanax side effects ed

LikeLike